In the United Kingdom, determining whether your car is taxed involves checking its Vehicle Excise Duty (VED) or road tax status. The UK’s Driver and Vehicle Licensing Agency (DVLA) manages this taxation system. Keeping your vehicle’s tax up to date is not only a legal requirement but also essential for smooth, worry-free driving. To get accurate and up-to-date information on road tax changes in 2023.

As of 2023, car tax rates in the UK may vary based on your vehicle’s CO2 emissions and fuel type. Electric vehicles (zero-emission) often enjoy tax exemptions. Petrol and diesel cars’ tax rates depend on their CO2 emissions, with higher-emission vehicles attracting higher taxes. Specific tax bands and rates can change yearly, so checking the latest DVLA guidelines for accurate information is essential. Stay informed about potential changes to ensure you meet your tax obligations and avoid penalties. Remember, staying eco-friendly with low-emission vehicles can lead to tax savings and contribute to a greener environment.

For example when sell my car need to inform the buyer about the road tax status. If the tax is still valid, transfer it to the new owner. Otherwise, refund the remaining tax.

Table of contents

- 1 Why should I do a car tax check on a UK registered vehicle?

- 2 How to I check is a vehicle taxed?

- 3 What is road tax? How it’s calculated?

- 4 How to check my car tax online?

- 5 Can I tax a car without a logbook?

- 6 How can I check if my vehicle is taxed?

- 7 The importance of checking car tax

- 7.1 Conclusion:

- 7.2 Answering your questions

- 7.2.1 What information do I need to check my car tax?

- 7.2.2 How can I check my car tax for free?

- 7.2.3 How do I know when to re-tax my car?

- 7.2.4 Can you tax a car without an MOT?

- 7.2.5 Can I drive my car while waiting for a tax update in the UK?

- 7.2.6 How much is road tax uk?

- 7.2.7 Which cars are road tax-free in the UK?

Why should I do a car tax check on a UK registered vehicle?

Car Tax Check: If you’re considering buying a used vehicle, you’ll want to know how much car tax you must pay. This can be one of the most confusing parts of buying a second-hand car or motorcycle, especially if you need clarification on whether the vehicle might be exempt from any tax

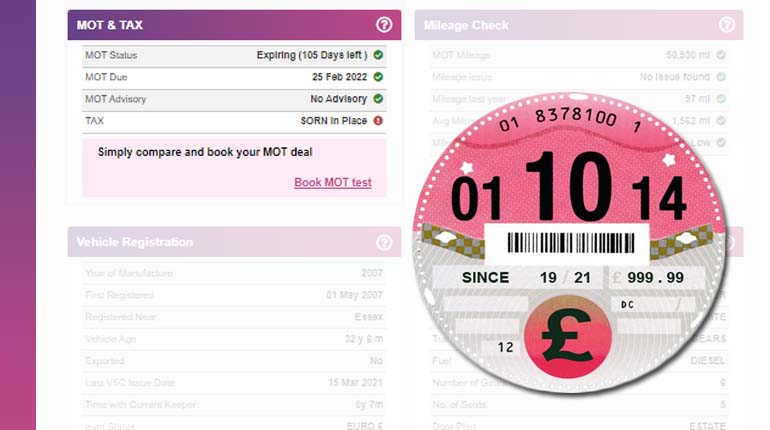

Check if a vehicle is taxed or not. Enter the registration number and press the ‘check vehicle’ button.

How to I check is a vehicle taxed?

Driving an untaxed vehicle on UK roads can result in penalties, so it’s crucial to stay compliant. Trust our reliable service for accurate and up-to-date results. You can check the road tax status of any vehicle by entering the registration number of any vehicle using our car tax checker.

This will tell you the vehicle information that is currently taxed and, if so, how much tax is due. If the vehicle is not taxed, you will need to pay the appropriate amount of tax before you can use it on the roads. Prices for road taxes are available for 6 and 12 months.

You can pay your vehicle tax online with the DVLA or at a post office. The cost of vehicle tax varies depending on the vehicle’s make, model, age, engine size, and fuel type.

What is road tax? How it’s calculated?

Road tax, also known as vehicle excise duty (VED) or car tax, is a mandatory tax government imposes on vehicles using public roads. The tax amount varies based on the vehicle’s CO2 emissions, engine size, and fuel type. It helps fund road maintenance and infrastructure projects.

You can instantly check your road tax status and the MOT history check of your vehicle and registration for free.

How to check my car tax online?

If you want to check your car tax online in the UK, The auto experts are one of the best online platforms. By entering your vehicle’s registration number in the search bar, you can instantly view its current tax status, including the tax expiry date. This user-friendly online service helps you ensure compliance with UK road tax regulations and avoid penalties. Don’t risk driving without tax; use this efficient tool to verify your car’s tax status in real time. Stay road-legal and enjoy a hassle-free driving experience by checking your car tax online today.

You can tax your vehicle online through the DVLA’s website and have your V11 and V5c documents to hand.

Can I tax a car without a logbook?

If you’ve misplaced your logbook or it has been lost, stolen, or damaged, you can still tax your car by obtaining a V5C/2 form, also known as a “new keeper supplement.” You can get this form from a Post Office branch or apply online through the DVLA (Driver and Vehicle Licensing Agency) website. The V5C/2 form is a temporary logbook allowing you to tax your car immediately. However, contacting the DVLA to request a replacement logbook for future reference is essential. Check the UK government’s official website or contact the DVLA for the latest and most accurate information.

How can I check if my vehicle is taxed?

If caught driving an untaxed vehicle, you could face a fine of up to £1,000. You can utilise the government’s official online service to check if your vehicle is taxed in the UK. Visit the website check vehicle tax gov and input your vehicle’s registration number into the provided search bar. After submitting the details, the system will promptly display the current tax status of your car, including the tax expiry date.

The importance of checking car tax

Checking your car tax is crucial for several reasons:

- It is a legal requirement to guarantee your vehicle has a valid tax. Fines may result from failing to do so, and even the possibility of your car being clamped or impounded.

- You can confirm your current payments by checking your car tax and avoiding unexpected penalties.

- Checking your car tax provides peace of mind and helps you maintain a responsible approach to vehicle ownership.

Conclusion:

Checking your car tax is a crucial aspect of responsible vehicle ownership. The Auto Experts’ free car tax check service offers a convenient and reliable way to stay updated on your tax status. By providing this service free, we aim to promote compliance with the law and help our customers avoid unnecessary penalties. Please use our user-friendly platform to ensure your car tax is current. Trust The Auto Experts for a hassle-free and accurate car tax checking experience.

Answering your questions

What information do I need to check my car tax?

You typically need the vehicle’s registration number to check your car tax. This unique identifier allows the system to retrieve the necessary information about the car, including its tax status, emissions, and other relevant details.

How can I check my car tax for free?

To check your car tax for free, you can visit the official website of the Driver and Vehicle Licensing Agency (DVLA) in the United Kingdom. They provide an online service where you can enter the vehicle’s registration number and check its tax status. Or check with us; we ensure that providing reliable and secure is essential for free car tax checks.

How do I know when to re-tax my car?

To know when to re-tax your car, check your vehicle tax disc or visit DVLA’s website for the expiry date. Re-tax annually to avoid penalties or fines for driving without valid tax. Set reminders to stay updated.

Can you tax a car without an MOT?

Yes, you can tax a car without an MOT certificate, but only if it’s exempt from MOT requirements. This typically applies to cars over 40 years old, electric vehicles, and others. Otherwise, you need a valid MOT certificate to tax your car in the UK.

Can I drive my car while waiting for a tax update in the UK?

No, you cannot drive your car without a valid tax. It must be taxed before driving on public roads in the UK. Driving without tax may result in penalties or fines.

How much is road tax uk?

The UK’s road tax (Vehicle Excise Duty) varies based on your car’s CO2 emissions and fuel type. Rates start from £0 for zero-emission vehicles to over £2,000 for high-emission cars. Visit DVLA’s website for specific rates applicable to your vehicle.

Which cars are road tax-free in the UK?

Electric cars (zero-emission vehicles) are road tax-free in the UK. However, it’s essential to check the current DVLA guidelines, as tax rates and policies may change over time.