UnSORN (Statutory Off Road Notification) a car involves a simple process to reactivate it for road use legally. Update your vehicle’s V5C (logbook) with the latest information, renew your tax, and ensure valid insurance. If using the paper V5C, mark the relevant section and send it to DVLA. For online transactions, navigate to the official DVLA website and follow the steps. Once completed, you’ll receive a confirmation, and your car will no longer be SORNed. This process is typically free and ensures your vehicle is road-legal again. Remember, driving a SORN car without following these steps can result in fines or penalties, so completing the UnSORN process is essential before taking your car back on the road. To know how do i find my log book reference number online by reg number.

Table of contents

- 1 What does “SORN” mean?

- 2 How to check a tax sorned vehicle?

- 3 How do I declare a vehicle as SORN?

- 4 What are some reasons I may want to apply for a SORN?

- 5 What are the rules and regulations for SORN vehicles?

- 6 Can i buy or sell a SORN vehicle?

- 7 How to check a vehicle SORN status?

- 8 Check vehicle sORN status online:

- 9 How to UnSORN a vehicle?

- 10 How long will a SORN last?

- 11 How much does a SORN cost?

- 11.1 Conclusion

- 11.2 Answering your questions

- 11.2.1 How does SORN affect insurance?

- 11.2.2 How do you Unsorn a car without a v5?

- 11.2.3 Can you drive a SORN Vehicle?

- 11.2.4 Does SORN transfer automatically when car ownership is transferred?

- 11.2.5 Where can I park my car with SORN?

- 11.2.6 How do I UNSORN a vehicle?

- 11.2.7 Do you get a refund if you SORN your car?

- 11.2.8 Can I SORN my car without v5 or v11?

- 11.2.9 Can you drive a SORN car to scrap?

- 11.2.10 Does a SORN car need to be insured?

What does “SORN” mean?

SORN, short for ‘Statutory Off Road Notification,’ is an acronym used by the DVLA (Driver and Vehicle Licensing Agency) in the United Kingdom. When a vehicle is declared as SORN, it serves as a notification to the DVLA that it will be off the road and not in use. This applies primarily to cars, motorcycles, and light commercials.

Once the DVLA has been informed and the vehicle is registered as SORN, the registered keeper is allowed a refund of any remaining road tax from their annual or biannual payments. This ensures the owner is not paying road tax for a vehicle not being used or kept on public roads.

How to check a tax sorned vehicle?

To check the status of a SORNed vehicle, follow these steps. Visit the official DVLA website or use their helpline. Provide the vehicle’s registration number and make. The DVLA will confirm if the car is SORNed or taxed. This process helps verify the current legal status of the vehicle and ensures accurate information for potential buyers or owners. Stay informed effortlessly with this simple check and make well-informed decisions regarding your or someone else’s vehicle.

How do I declare a vehicle as SORN?

No longer need your ride? Make sure you declare your vehicle as SORN to get rid of insurance and road tax. How to SORN a car? Following are the three ways you can declare SORN to DVLA:

Online: Visit the official website at gov. uk/make-a-sorn to make a SORN declaration. You will need either:

- The 16-digit reference number from your tax renewal letter (V11), or

- The 11-digit reference number from your logbook (V5C).

By phone: Call 0300 123 4321 to declare your vehicle as SORN. This service is available 24/7.

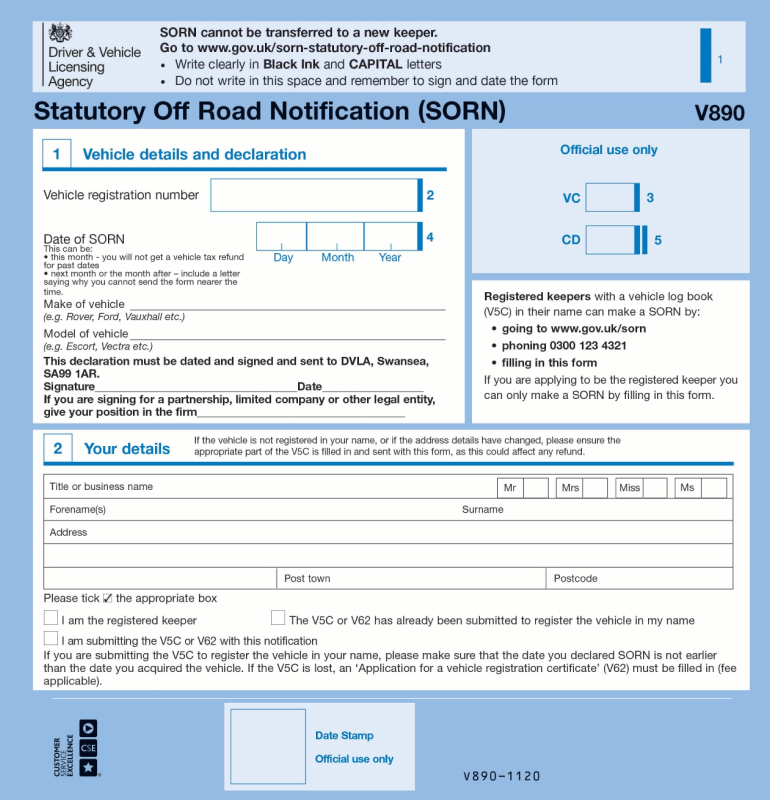

By post: Fill in form V890 to declare your vehicle as SORN. Then, send the completed form to the DVLA (Driver and Vehicle Licensing Agency).

What are some reasons I may want to apply for a SORN?

There are numerous reasons why individuals prefer to declare their vehicle as SORN (Statutory Off Road Notification). Some common motivations include:

- Extended holiday or reduced usage: If you’re planning an extended vacation or won’t be using your car for a while, considering alternative transportation, like public transit, can be both convenient and cost-effective. In such situations, declaring a SORN can help you avoid expenses associated with car insurance, car tax, and MOT test checks.

- Vehicle modifications or repairs: If you have purchased a vehicle but plan to make repairs or alterations before putting it on the road, declaring a SORN allows you to avoid immediate costs associated with insurance, tax, and MOT checks until the vehicle is roadworthy.

- New vehicle acquisition without immediate use: If you have recently purchased a new vehicle but haven’t started driving it yet, such as when you are waiting to pass your driving test, declaring a SORN can help you postpone expenses until you are ready to use the vehicle.

- Vehicle dismantling or non-insured status: If you plan to break down the vehicle for parts or if the car is not insured and cannot legally be driven on the road, declaring a SORN ensures compliance with regulations and relieves you from financial obligations.

What are the rules and regulations for SORN vehicles?

The number of SORN vehicles has dramatically increased, especially in the pandemic. Many false rumors about SORN resulted in many fines. Therefore, in June 2021, the DVLA set out and reminded SORN restrictions to save people from getting a vehicles penalty for driving a SORN car. Following are those reminders:

- SORN vehicles must always be kept off public roads, including parking and driving.

- SORN vehicles are exempt from road tax and do not require insurance coverage.

- To declare a SORN, you must inform the DVLA online or by phone or by sending a completed V890 form.

- Validity of a SORN declaration continues until the vehicle is taxed, scrapped, exported, or permanently registered as off the road.

- Non-compliance with SORN regulations may result in fines and penalties.

It’s important to note that these regulations also apply to electric vehicles (EVs). EV owners can declare their vehicles as SORN if they meet the eligibility criteria. By declaring a SORN for an electric car, owners can save on road tax and insurance costs while the vehicle is not in use.

Can i buy or sell a SORN vehicle?

Yes, buying or selling a SORN car is possible and legal. However, it gets pretty complicated since you can’t have a test drive. Most buyers ask for a test drive before proceeding with the deal. Likewise, you must ensure MOT status, insurance, and car tax when selling the vehicle privately.

The same goes for buying a SORN car; the prohibitions weaken your trust in the vehicle. Long story short, it becomes challenging and confusing to buy or sell a car with SORN.

How to check a vehicle SORN status?

Is your car still SORN? Usually, when declaring or removing a SORN, you want to confirm if the car SORN is active or terminated. It’s essential to check if a vehicle is SORN because driving a SORN vehicle may subject you to a £2500 fine. So, here is the best and most authentic way for a car SORN check:

1. Check SORN status through the government portal:

Visit the government portal to the “vehicle tax, SORN and vehicles exempt from vehicle tax” section. Select “check a vehicle’s SORN status”, enter the car’s registration number and make. The website will indicate if the vehicle is on SORN.

2. Utilize askMID.com to verify insurance and SORN status:

Use the askMID database to check SORN and insurance status. If you receive an Insurance Advisory letter from the DVLA, you must insure the vehicle or accept a fine.

Find free insurance quotes from over 100 providers through our partner.

3. Visit the DVLA website:

Visit the DVLA website and perform a free car check. This provides information on MOT status, tax rates, and carbon emissions. If the report indicates that the vehicle’s current tax status is unknown, it suggests that it has not been declared as SORN for an extended period.

Check vehicle sORN status online:

The vehicle SORN check is available at The Auto Experts for free. Plus, you get other basic information about the car. However, a comprehensive report will cost you £9.99, providing critical vehicle history to help you make an informed decision.

How to UnSORN a vehicle?

It’s straightforward! You just need to pay car tax to un-SORN your vehicle. In order to pay vehicle tax, visit the Vehicle Tax Section of the Gov. uk website. Follow the instructions given on the website, and there you go!

Is it taxed and insured now? Well, a careful person would check:

- SORN status

- Insurance status – Check if it is valid and has not expired.

- MOT status – Check if the MOT has not expired.

If the SORN was active for more than a year, we suggest you check all the above vehicle information. And why take a risk when all this information is available for free at The Auto Experts?

How long will a SORN last?

A SORN (Statutory Off Road Notification) declaration remains in effect until the vehicle is taxed and put back on the road, sold or transferred to a new owner, scrapped or permanently exported, or the DVLA revoked or cancelled the vehicle’s registration.

A SORN has no specific time limit and continues until one of these events occurs. Ensuring the car is properly taxed and insured before driving it on public roads once the SORN status is lifted is crucial.

How much does a SORN cost?

Declaring a SORN for a vehicle in the UK is free of charge. There is no cost associated with applying for or maintaining a SORN. It is a legal requirement that allows vehicle owners to keep their vehicles off public roads while saving on car tax and insurance premiums.

Conclusion

UnSORNing your car online in the UK is a convenient and straightforward process that ensures you can legally drive your vehicle on public roads once again. The Driver and Vehicle Licensing Agency (DVLA) has made it easier than ever to manage your vehicle’s SORN status online, saving you time and effort.

Answering your questions

How does SORN affect insurance?

A Statutory Off-Road declaration declares your vehicle Off the road. A SORN means it does not need to be insured, taxed, or registered. MOT’d also means you can’t drive it. Despite this, Car Insurance isn’t automatically cancelled by a SORN.

How do you Unsorn a car without a v5?

Fill out the V62 ‘Application for a Vehicle’ Form for ‘Registration Certificate’. You’ll find it easiest if none of these apply. The information you provided during registration has changed.

Can you drive a SORN Vehicle?

You can only drive a SORN-declared car on public roads if you’re going to a pre-booked MOT appointment. Driving it for any other reason is illegal and may result in a court prosecution, with fines of up to £2,500.

Does SORN transfer automatically when car ownership is transferred?

No, SORN does not transfer automatically when car ownership is transferred. The new owner must inform the DVLA and make the necessary arrangements regarding the vehicle’s taxation and SORN status.

Where can I park my car with SORN?

When you have declared your car as SORN (Statutory Off Road Notification), you should keep it parked off public roads. You can park it on private property, such as your driveway or garage, or any other personal parking space you can use.

How do I UNSORN a vehicle?

To un-sorn a vehicle, fill out a V5C form, update tax and insurance, and submit. Online or at a post office, it costs £0.

Do you get a refund if you SORN your car?

Yes, you can get a refund for any full months of remaining tax when you SORN your car. Notify the DVLA, and they’ll process the refund automatically.

Can I SORN my car without v5 or v11?

No, you need the V5C (logbook) or V11 reminder to SORN your car. These documents provide essential details for the process. Contact DVLA if you don’t have them.

Can you drive a SORN car to scrap?

No, you can’t legally drive a SORN car even to a scrapyard. To transport it, use a trailer or tow truck. Ensure tax and insurance are valid, or notify DVLA for disposal. Follow legal procedures to avoid penalties.

Does a SORN car need to be insured?

Yes, even if a car has a SORN (Statutory Off Road Notification) status, it must still be insured unless it’s kept on private property. Insurance is legally required for any car driven on public roads, regardless of its SORN status. Keep your vehicle properly insured to avoid legal complications.